Poor policy on tobacco and vaping supports organised crime

Posted on August 3, 2023 By Colin

FLAWED GOVERNMENT POLICIES on tobacco and vaping have been major drivers of organised crime in Australia. High tobacco taxes and harsh restrictions on vaping have created rampant black markets run by criminal gangs, causing widespread harm and public concern.

Tobacco taxes and criminal activity

Australia has the highest priced cigarettes in the world. A pack of 20 Marlboro costs AUD $40. The same pack is AUD $24 in the UK and AUD $13.50 in the US.

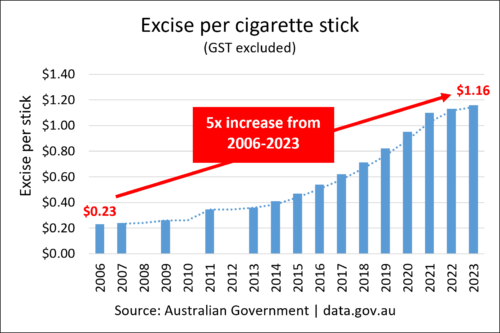

Cigarette excise has risen 5-fold over the last 15 years more than any other tax, and is now $1.28 per stick (including GST) or 65% of the retail price. This a bonus to the treasury, generating $13.8 billion in tax in 2012-22, more than petrol and alcohol combined. (Budget Papers 2023-24 #1, p185). Further annual increases were announced in the last budget.

Tobacco excise has increased 5-fold in 15 years

The Australian government has mercilessly milked the tobacco cash cow without considering the consequences

The high tobacco prices have predictably led to a demand for cheaper products and have created a booming black market run by criminal organisations.

An estimated 20-25% of the total tobacco market is illicit, imported by criminal gangs. Only 15% of illegal tobacco is detected at the border despite substantial enforcement costs.

Organised crime groups are associated with violence and turf wars, and corruption of border and customs staff. Intimidation, extortion and firebombing of retailers have been recently reported in Victoria and Queensland

Money raised from tobacco sales is laundered and used to fund other criminal activities.

Tax rises can be justified if they are reducing smoking rates, but they are not. Smoking rates in Australia have not declined significantly over the last 4 years. Many addicted smokers will continue to smoke no matter what the price.

Tobacco taxes are regressive - they harm low income and disadvantaged groups the most. At these eyewatering levels they cause huge financial stress for smokers who are addicted and unable to quit. Many people believe that high taxes are more about generating government income, rather than a health strategy

Other results of illicit tobacco are huge losses of tax revenue - an estimated $3.4 billion in 2021 according to KPMG – and substantial enforcement and policing costs. Cheaper illicit tobacco also undermines the financial incentive to quit smoking and has a serious effect on legal tobacco retailers.

Vaping and organised crime

Australia’s prohibitive vaping regulations have also been a boon to organised crime groups. The crackdown on vaping has also created a thriving black market that provides easy access for young people to dodgy products of unknown quality.

Only 8% of Australia’s 1.3 million vapers have a prescription for nicotine and 92% purchase supplies through illegal channels.

Illegal vapes are a low-risk high-profit crime. Vapes that cost $3 from a Chinese factory are sold for $35 in Australia.

According to Rohan Pike, who led the initial ABF Tobacco Strike Team, “The same organised-crime groups who are bringing in illicit tobacco are bringing in the vapes”

Pike says, “It’s impossible to stop this at the border.” An estimated 90-100 million illegal vapes are imported each year and the Australian Border Force (ABF) has admitted they are not a priority. The ABF is under resourced at the best of times, and no additional funding has been allocated for vape detection.

8 million shipping containers enter Australia each year. Only 1.3% are scanned

Michael Outram, chief of the ABF, says the Border Force is focussed on preventing the importation of illicit drugs, firearms, child pornography material. Blueberry vapes are way down the list of priorities.

The current laws perversely criminalise vapers who are at risk of prison sentences and substantial fines for using vapes to quit smoking.

Government action is needed

Australia’s approach to tobacco and nicotine vapes has been a gift to criminal gangs. High tobacco prices and harsh restrictions vapes have created a thriving black market for both illicit tobacco and dodgy vaping products

The government should stop pretending that further tobacco excise increases will reduce smoking rates and should immediately stop any further tax rise.

We should also legalise and regulate vapes as adult consumer products sold from licensed retail outlets, with strict age restrictions. The vape black market will gradually diminish as vapers have easy access to legal, regulated supplies.

The only losers from these changes will be criminals. As Cate Faehrmann MP said this week, "These gangsters will be on Centrelink in six months if you legalised drugs.” What is holding us back?